Palo Alto City Council Member Pushes for Separation of Money and State

[ad_1]

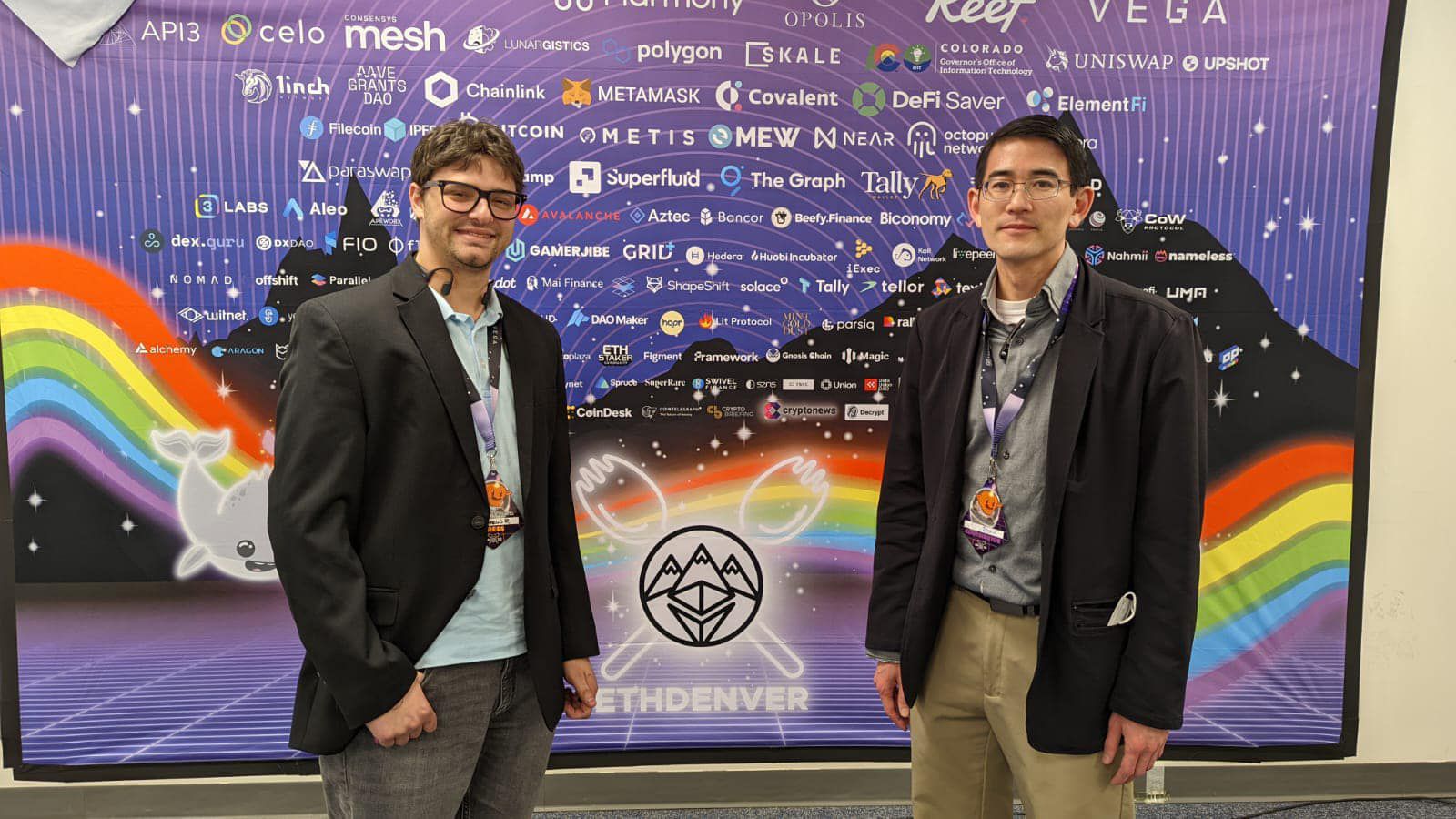

Palo Alto City Council member Greg Tanaka (D-CA) sat down with Be[In]Crypto at ETHDenver ahead of his Congressional run, explaining why there needs to be a separation of money and state.

Tanaka, who was re-elected to the Palo Alto City Council in November 2020, announced his intention to run for U.S. Congress for the 18th District, challenging long-term incumbent Anna Eshoo and the seemingly anti-crypto perspective surrounding cryptocurrency’s infrastructure and utilization.

Implementing separation of “money and state”

In pushing his proposal, Tanaka sat down with Be[In]Crypto at ETHDenver 2022, and broke down how the separation of money and state would tentatively look like.

“I think what we will see, beginning with how our country was born, every town had their own form of currency, which was insane because they didn’t have smartphones or easy accessibility to be able to transfer and convert the currency. Now, we have all these bridges to link currencies together, without having to do the math. The math is done by software and technology. I think we should allow crypto as legal tender, especially Bitcoin.”

In the short-term, Tanaka believes Bitcoin will “probably be a parallel currency to the U.S. dollar, which is a good thing. While Ethereum also has that potential with its smart contracts, it’s also an interesting conversation.”

Looking at El Salvador’s embrace of crypto, Tanaka also believes that programs like CityCoin in areas such as MiamiCoin and NewYork are the future.

“We only have so much revenue, and the dollars we have right now are being whittled away because of inflation,” he said. In reality, Bitcoin is incredibly green and energy-efficient if you’re having the right conversations.

“We need to fully embrace this technology, rather than pushing against it.”

Should there be a capital gains holiday for crypto?

Since the collapse of The Silk Road in 2013, cryptocurrency has certainly taken on a very dark, negative association with U.S. regulators and lawmakers, who are resistant to fully embrace the digital asset’s utility in the U.S. economy.

The recent infrastructure bill, which is crucial for a more comprehensive understanding of the digital asset, didn’t help either, according to Tanaka. “What this infrastructure bill does is put a knife above everyone’s head, where individuals could face a state or federal felony, subject to five years in prison and up to a $25,000 fine,” he told Be[In]Crypto.

He compared the innovation and overall atmosphere at ETHDenver to the conversations that first sparked with the birth of the internet in 1995. “When I look back to the internet in 1995, and what the government did – it was great. They gave a tax holiday on e-commerce, allowing the industry to flourish. Imagine if we didn’t have e-commerce during the COVID-19 pandemic; we would have been totally screwed.”

As part of Tanaka’s Congressional campaign, he believes we should be doing something similar with cryptocurrency. “I think we should also have a capital gains holiday, where you sell your Bitcoin to USDC, or you go from USDC to Tether or Avalanche, or whatever it happens to be. My preference would be having no capital gains at all for the next decade, so as to allow this industry to flourish.”

Software has finally eaten money

One of the biggest drivers behind Tanaka’s campaign and time in Palo Alto’s City Council, revolves around pushing for the separation of money and state.

“Similar to how there is a separation of religion and state, I firmly believe there should be a similar separation as it involves money and state,” he said, adding that the religion and state separation was “revolutionary at the time for the U.S. government and for the U.S. Constitution.”

In the past, money fundamentally had to be something that the government did, to ensure security of the money supply, ranging from involving the Secret Service, anti-money laundering and counterfeiting teams, police, court system, and utilizing bank vaults.

Today, according to Tanaka, software has finally eaten money, playing off one of his company’s investors, Marc Andreessen’s sayings of how software has eaten the world.

“Ironically, software has finally eaten money, because before crypto, you had to have the Secret Service, bank vaults, and specialized security fibers running through the dollar bills, and all these systems in place to secure the money supply. If you look at how much this costs in terms of power and money, it’s astronomical.”

Yet, with cryptocurrency, these mechanisms and systems are no longer needed due to the asset’s extremely secure and fast ability to be transferred and exchanged.

Over the last year, the U.S. government has only printed 40% of U.S. dollars currently in circulation. In its efforts to pay for approximately $29 trillion in U.S. debt, The Federal Reserve has continued to print money, while recognizing that almost 40% of American adults wouldn’t even be able to cover a $400 emergency with cash, savings, or a credit card.

Tanaka says that with the U.S. serving as the dominant economy since World War II, its efforts of attempting to debase currency only leads to the “sun setting on our country, which is not good.”

Congress is out to lunch

It’s no secret that Congress has been extremely resistant to address or implement any new changes associated with Bitcoin and other cryptocurrencies.

But is its fear hurting the push forward for the U.S. in maintaining its status as a dominant economy?

“I think Congress is out to lunch,” Tanaka said.

“My current Congressional opponent who will be 80 this year, isn’t the most tech savvy person in the world, I spent time trying to explain what crypto is to other members of Congress about its promise, but they don’t get it. With 10% to 20% of the U.S. economy going towards our financial system, and you look at what Congress is doing – they’re just moving numbers on a spreadsheet; they’re not adding a lot of creative value. Yet, they’re taking so much value from the system, asserting this tax on the U.S. economy.”

With traditional finance already heavily regulated, single transactions through Wells Fargo and Visa impose an approximate 3% fee on every transaction. Speaking to this, Tanaka pointed to how crypto is a way more efficient system that doesn’t require a standing army to defend.

“We should be embracing this technology, because in 100 years or so, we will look back to this moment and realize how cryptocurrency is one of the greatest inventions.”

Today’s generation needs to “get involved”

With today’s generation of millennials and Gen-Z attending conferences like ETHDenver, the ongoing issue revolves around the unequal spread of digital natives as it compares to digital immigrants.

“In Palo Alto, the seniors dominate the vote, outvoting everyone 3 to 1,” Tanaka explained. “If you look at Congress, while the incumbent in my district is 80 years old, the average age is almost 70.”

Speaking to younger folks at ETHDenver, Tanaka says it’s crucial to wake up and get involved.

“What they should be doing is getting involved. I think there’s a lot of promise with DAOs, especially with Lobby 3. It’s important to get involved in the campaigns like mine, who are running pro-crypto campaigns for Congress. To win, we need to knock out some of the anti-crypto incumbents, and put the fear of God into this pushback.”

Rather than going underground or leaving the country he encourages ETHDenver attendees to get involved and support these campaigns wherever they may be.

“The biggest thing you can do is vote and donate to these campaigns, because this year is a pivotal year. Unless people get involved now, the Treasury Department will most likely come out with incredibly onerous rules. We need term limits for incumbents. We need fresh perspectives. We need a legislator for the digital age.”

You can learn more about Greg’s pro-crypto Congressional campaign by visiting his website.

Be[In]Crypto will be on-site providing you real-time coverage from ETHDenver, highlighting the innovations across Web3 and cybersecurity.

What do you think about this subject? Write to us and tell us!

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link