Bitcoin Begins Bull Market? These Eight Key Indicators All Just Turned Green for the First Time Since Early 2021

[ad_1]

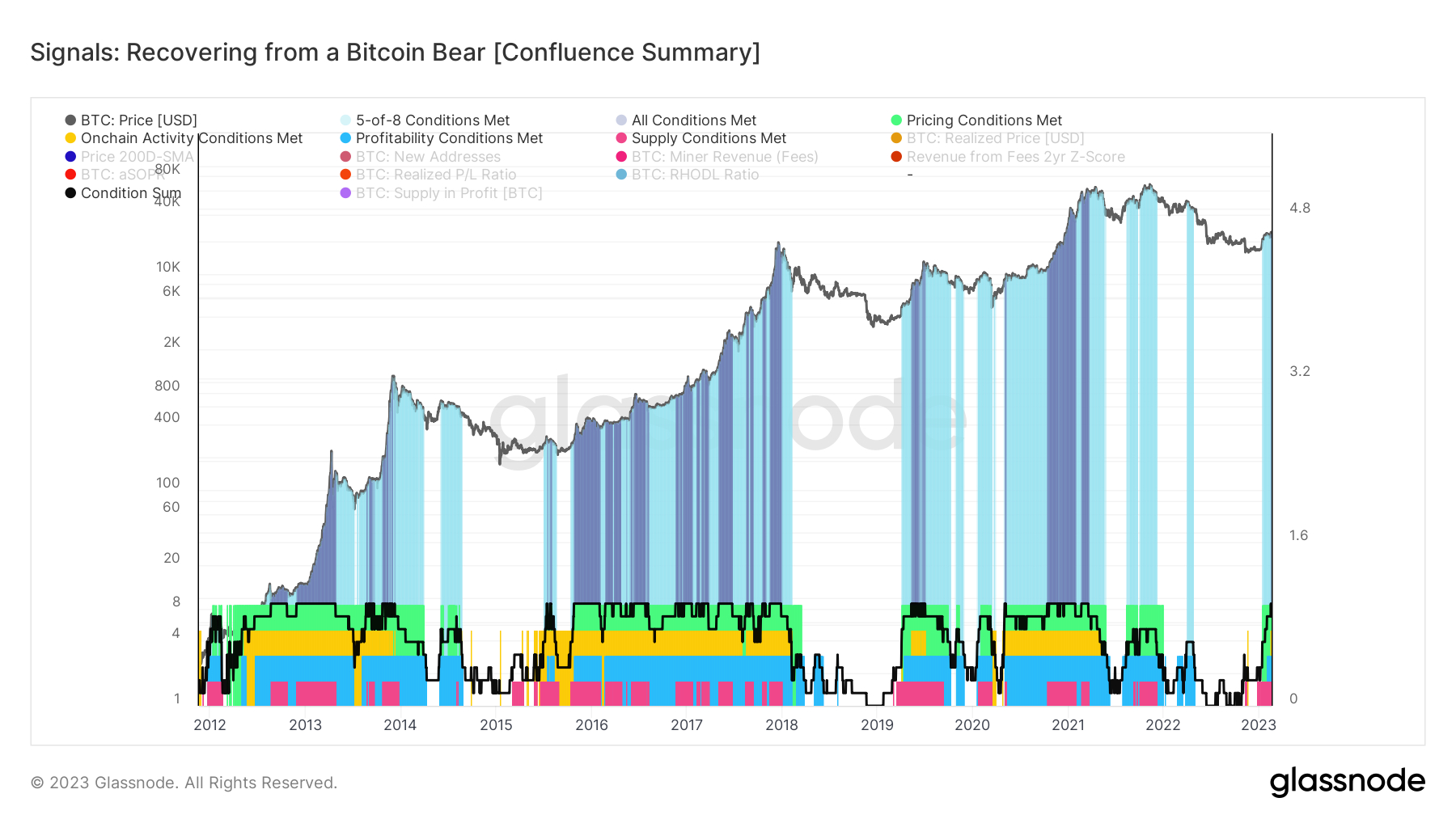

Earlier this week, eight out of eight key on-chain and technical indicators tracked by crypto analytics firm Glassnode’s “Recovering from a Bitcoin Bear” just signaled that the next Bitcoin bull market might be here. That was the first time that all eight indicators had been flashing a BTC buy signal in unison since March 2016.

Glassnode analysts utilize the “Recovering from a Bitcoin Bear” dashboard to gauge whether Bitcoin might be in the process of transitioning from a bear market into a longer-term bull market. The dashboard analyses whether Bitcoin is trading above key pricing models, whether or not network utilization momentum is increasing, whether market profitability is returning and whether the balance of USD-denominated Bitcoin wealth is in favor of the long-term HODLers.

On Thursday, one of the indicators (the 2-year Z-score of the Revenue From Fees Multiple) reserved slightly and was no longer flashing a buy signal. However, this reversal will likely be short-lived and all eight indicators are likely to soon start flashing green in unison once again.

This could have important implications for the Bitcoin price. As the graphic above demonstrates, during a Bitcoin bull market, it is common to see Glassnode’s “Recovering from a Bitcoin Bear” dashboard switching between all eight and less than eight indicators flashing green. This doesn’t itself mean anything for the Bitcoin price.

What is more meaningful here is when you consider the moment when all eight of the indicators of the dashboard start flashing green for the first time after a prolonged Bitcoin bear market. The last time this happened was during October 2020, when Bitcoin was trading around $11,500. By April 2021, Bitcoin had surged into the $63,000s. Prior to October 2020, all eight indicators hadn’t been flashing green since July 2019, aside from a brief period in April 2020.

Other examples of when all eight indicators started flashing green for the first time in a long time following a prolonged Bitcoin bear market include in May 2019 and in October 2015. All of these past aforementioned instances represent excellent moments to have bought Bitcoin. If all eight of Glassnode’s Recovering from a Bitcoin Bear indicators start flashing green, as soon may be likely, analysts might thus interpret this as a signal that Bitcoin’s risk-reward at current price levels is very good indeed.

Breaking Down the Recovering from a Bitcoin Bear Dashboard

Below is a breakdown of each of the eight indicators used by Glassnode in their “Recovering from a Bitcoin Bear” dashboard.

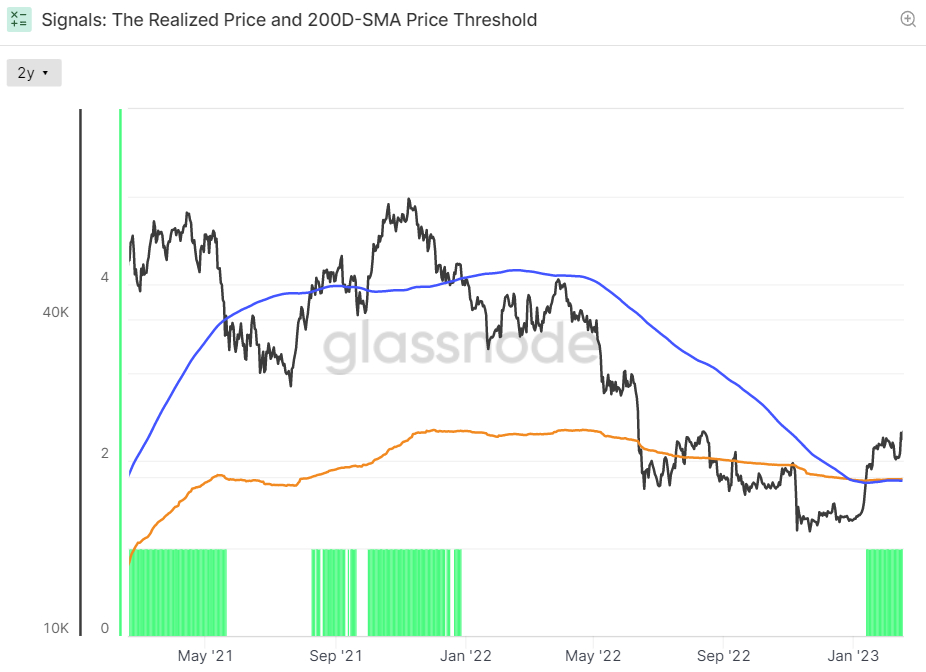

Signals 1 and 2 – Bitcoin Above its 200DMA and Realized Price

Bitcoin’s 2023 rally has seen it break to the north of its 200-Day Simple Moving Average (SMA) and Realized Price, the average price at the time when each Bitcoin last moved. Both are viewed as technical levels with key long-term significance. A break above them is viewed by many as an indicator that near-term price momentum is shifting in a positive direction.

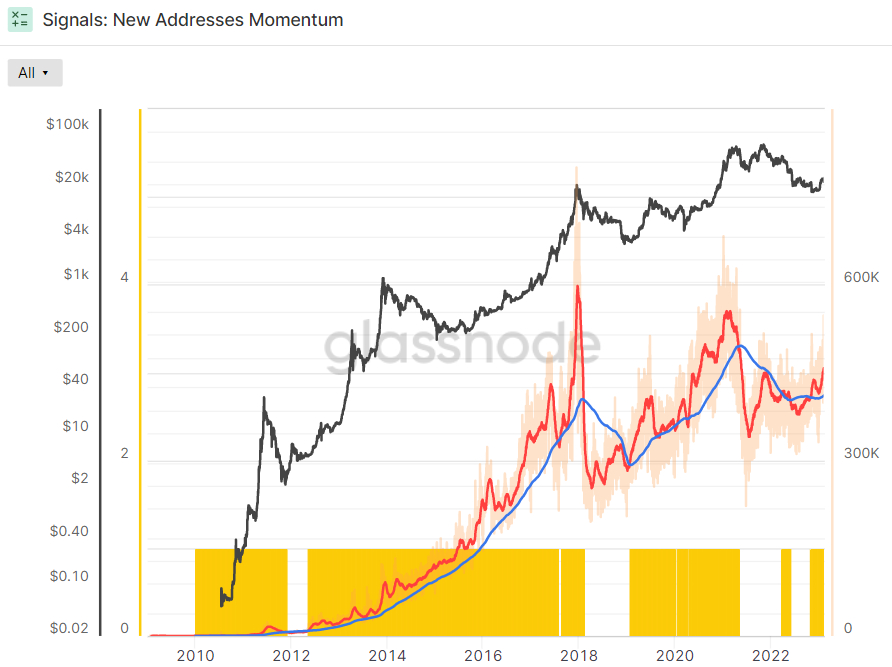

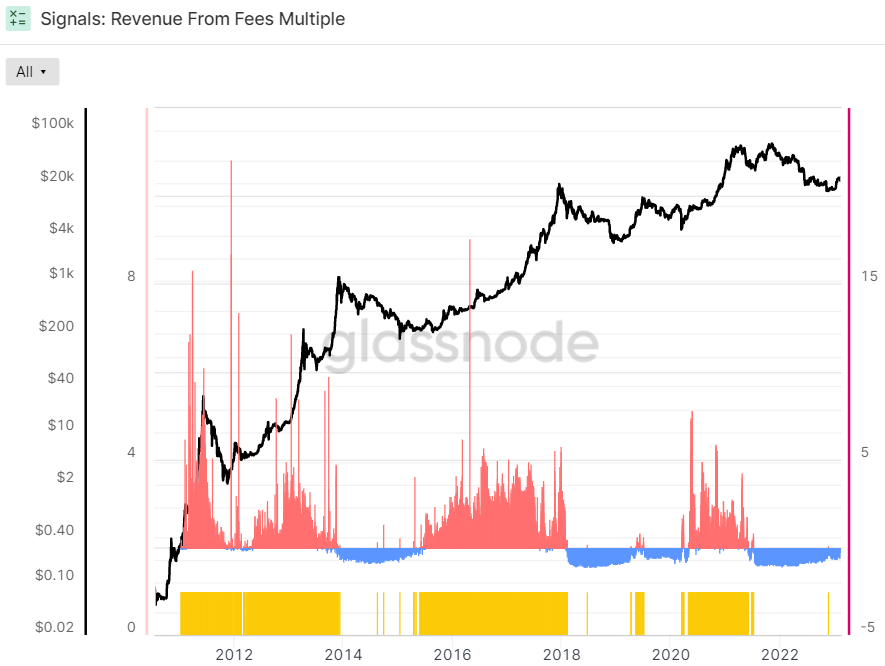

Signal 3 and 4 – New Address and Fee Revenue Momentum Are Positive

The 30-Day SMA of new Bitcoin address creation moved above its 365-Day SMA a few months ago, a sign that the rate at which new Bitcoin wallets are being created is accelerating. This has historically occurred at the start of bull markets.

The Revenue From Fees Multiple was the indicator that turned positive on Wednesday, only to then turn negative again on Thursday. The Z-score is the number of standard deviations above or below the mean of a data sample. In this instance, Glassnode’s Z-score is the number of standard deviations above or below the mean Bitcoin Fee Revenue of the last 2-years.

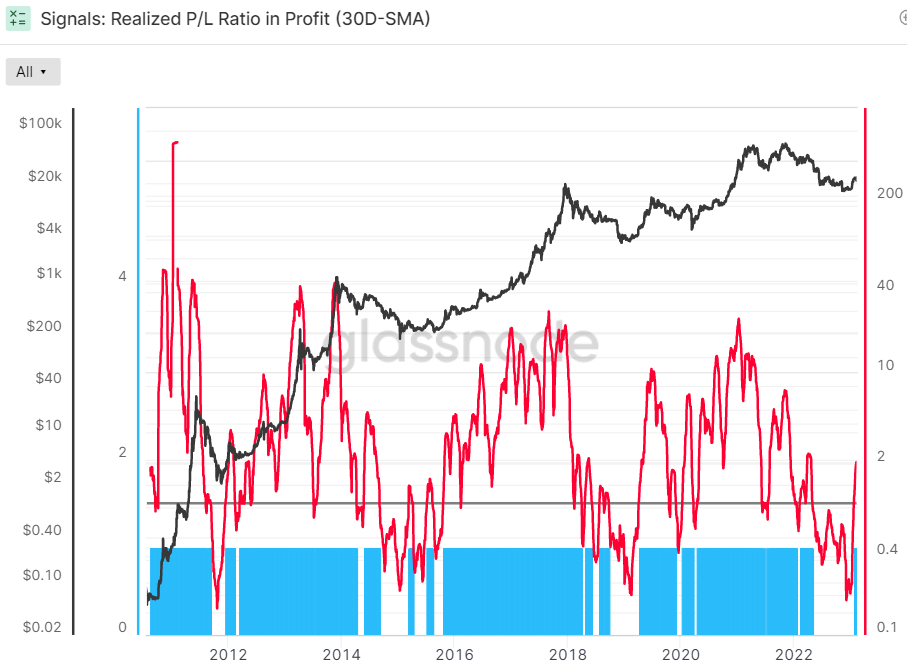

Signals 5 and 6: Market Profitability is Returning

The 30-Day Simple Moving Average (SMA) of the Bitcoin Realized Profit-Loss Ratio (RPLR) indicator moved above one a few weeks ago for the first time last April. That means that the Bitcoin market is realizing a greater proportion of profits (denominated in USD) than losses.

According to Glassnode, “this generally signifies that sellers with unrealized losses have been exhausted, and a healthier inflow of demand exists to absorb profit taking”. Hence, this indicator is sending a bullish sign.

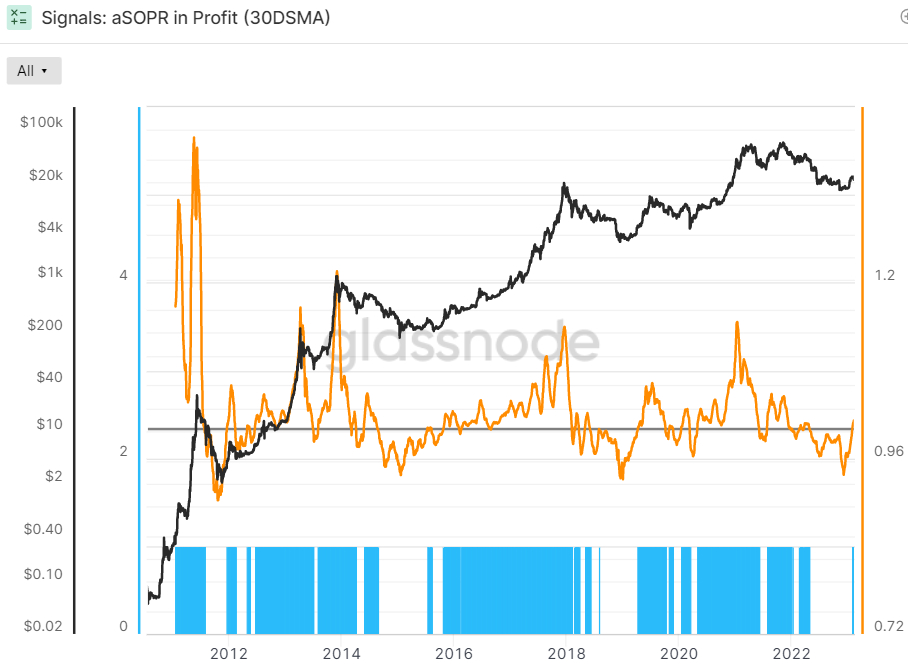

Meanwhile, the Adjusted Spent Output Profit Ration (aSOPR), an indicator that reflects the degree of realized profit and loss for all coins moved on-chain, also recently surpassed 1, indicating the market is in profit. Looking back over the last eight years of Bitcoin history, the aSOPR rising above 1 after a prolonged spell below it has been a fantastic buy signal.

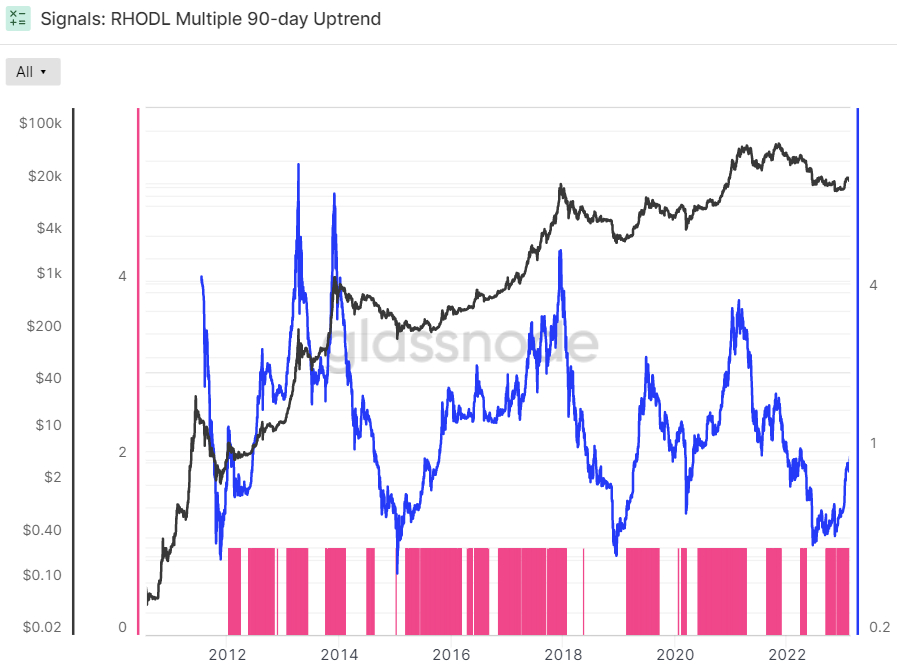

Signals 7 and 8: BTC Balance Has Moved In Favor of The HODLers

The Bitcoin Realized HODL Multiple has been in an uptrend over the last 90 days, a bullish sign according to Glassnode. The crypto analytics firm states that “when the RHODL Multiple transitions into an uptrend over a 90-day window, it indicates that USD-denominated wealth is starting to shift back towards new demand inflows”. It “indicates profits are being taken, the market is capable of absorbing them… (and) that longer-term holders are starting to spend coins” Glassnode states.

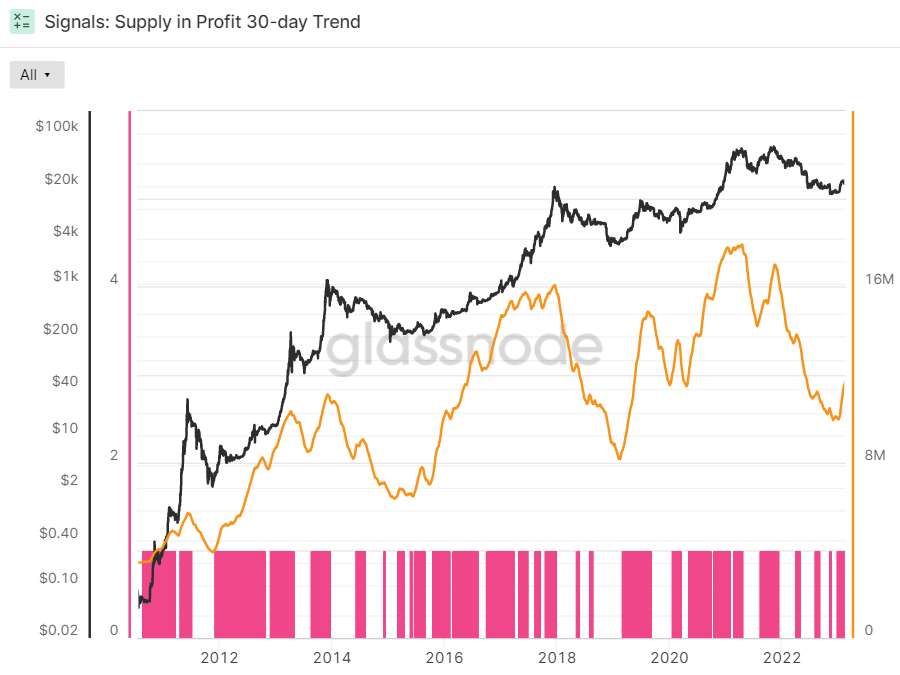

Glassnode’s final indicator in its Recovering from a Bitcoin Bear dashboard is whether or not the 90-day Exponential Moving Average (EMA) of Bitcoin Supply in Profit has been in an uptrend over the last 30 days or not. Supply in Profit is the number of Bitcoins that last moved when USD-denominated prices were lower than they are right now, implying they were bought for a lower price and the wallet is holding onto a paper profit. This indicator is also flashing green.

Glassnode’s widely followed dashboard comes at a time when a laundry list of other popular on-chain and technical indicators are also flashing bullish signals.

Read more: Bitcoin Bears Beware – Yet Another Key Metric is Flashing a BTC Buy Signal

Given all of the above, perhaps it should come as no surprise that Bitcoin continues to defy macro headwinds, such as the recent move higher in the US dollar and US bond yields driven by a build-up of Fed tightening expectations in wake of recent hawkish communications from policymakers following this month’s string of super strong tier one US data releases.

[ad_2]

Source link