iZUMi Finance officially unveils its veNFT DAO governance mechanism

[ad_1]

The protocol provides for a decentralised autonomous organisation (DAO) governance mechanism based on a Quadratic voting model.

iZUMi Finance, an innovative protocol for programmable liquidity mining built on the Uniswap V3 platform, has launched its highly anticipated decentralized autonomous organization (DAO), promising a revolutionary governance system powered by a quadratic voting mechanism.

According to an announcement shared with CoinJournal on Thursday, iZUMi Finance said its DAO governance token will be based on veNFT (veiZi).

The token is ERC271 standard compatible, meaning that users will have access to all the governance rights applicable to the platform. These will include the right to vote, boost and return staking rewards, iZUMi Finance said in the statement.

“veNFT’s are a major step forward for the industry in terms of NFT utilization. Whereas in most DAOs, governance votes are represented by the number of tokens held in a wallet, iZUMi DAO governance votes are represented by the number of tokens held within a veiZi NFT,” the protocol’s team added in their announcement.

On its Quadratic Voting mechanism, iZUMi Finance said:

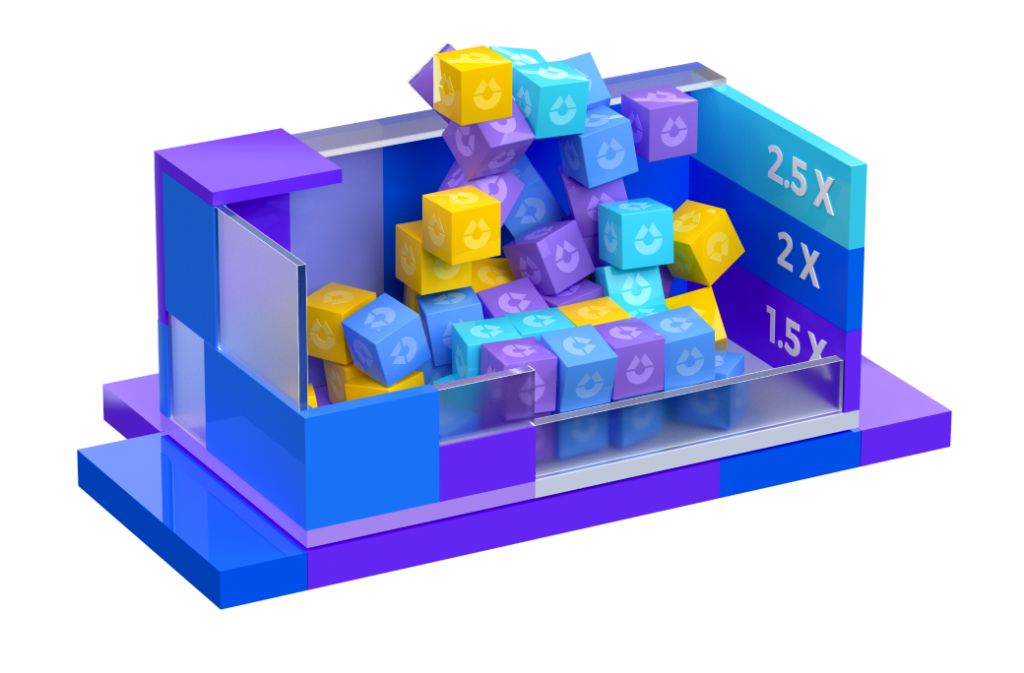

“Each cycle’s iZi emissions will be determined and allocated according to the outcome of veNFT voting. For staking rewards, 50% of the platform’s revenue will be used to buy back iZi, which will be allocated to veiZi NFTs according to voting power. With NFT staked, veiZi will be used to boost iZUMi i’s farming pool APR by up to 2.5 times.”

Minting veiZi NFTs

Users can mint veiZi NFTs via any iZUMi wallet address, which will happen when they lock their iZi tokens for a given period. However, it’s also possible to buy the tokens on third-party NFT marketplaces.

As an interest-bearing NFT, veiZi offers a unique opportunity for holders to get monthly rewards through staking.

An iZUMi wallet can only stake one veiZi NFT, but the platform’s technology allows for an extension of the locked period. If a user wants to, they also can opt to unstake their tokens once they successfully redeem their rewards.

iZUMi Finance’s programmable liquidity as a service feature is available on Uniswap V3 multi-chains.

DAOs have increasingly found a footing in recent months, with many users attracted to the commitment to decentralisation projects put forth via governance tokens.

Many projects now offer users the right to vote on governance issues, with the trend growing as decentralised finance (DeFi) becomes even more entrenched in the crypto ecosystem.

[ad_2]

Source link