Top 5 Altcoins to Keep an Eye on in November

[ad_1]

XRP, Injective (INJ), eCash (XEC), Hedera (HBAR), and the Graph (GRT) are all altcoins that have interesting developments lined up in November, which could affect their price.

The month of October was bullish for the cryptocurrency market, and the increase has so far continued in November. The five altcoins below could draw even more attention this month.

Ripple (XRP) Swell Conference Approaches

Price: $0.70

Market Cap: $37,622 billion

Rank: #4

The first November altcoin is XRP due to the Ripple Swell conference, which will be held on November 8-9 in Dubai. While the conference always receives considerable attention, expectations are even higher this time.

This is because there are rumors of a potential Initial Public Offering (IPO) announcement or an application for a Virtual Asset Regulatory Authority (VARA) license in the United Arab Emirates.

The XRP price broke out from a 98-day descending resistance trendline on October 19. It now trades at a very interesting area between the 0.5-0.618 Fib retracement resistance levels at $0.68-$0.74.

Read More: Best Upcoming Airdrops in 2023

According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction, and this theory can also be used to identify the peak of future upward movements.

The 0.5-0.618 Fib area often acts as the top if a movement is corrective.

Therefore, whether the price breaks out or gets rejected could determine the future trend.

A successful breakout can trigger a 35% price increase to the yearly high of $0.94. On the other hand, a rejection can initiate a 23% drop to the closest horizontal support at $0.55.

Injective (INJ) NFT Collection Contribute to Burn

Price: $17.89

Market Cap: $1,492 billion

Rank: #38

On November 11, the INJ price will launch the first-ever Non-Fungible Token (NFT) collection that will directly contribute to the INJ burn.

The mechanism of the Quants collection specifies that 5% of all volume of Quants will be burned. So, the more Quants get traded, the more tokens get burned. This can have a positive effect on the price by reducing the supply.

The price action for INJ is also bullish, mostly due to the Elliott Wave count. By studying recurring long-term price patterns and investor psychology, technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction.

The most likely count suggests that the price is in the fifth and final wave of an upward movement. The first potential target for the top is at $25, created by the 0.382 length of waves one and three.

The target is 40% above the current price and close to the all-time high of $25.30.

If the rally extends, the next resistance will be $36.50, 100% above the current price.

On the other hand, a bearish trend reversal can lead to a 45% drop to the closest support at $10.

eCash (XEC) Upgrades Network

Price: $0.000029

Market Cap: $586,552 million

Rank: #71

A new eCash network upgrade will launch on November 15. The upgrade will introduce a 10% block reward allocated as a staking reward. Additionally, it will increase the miner fund block reward from 8% to 32%.

The XEC price trades above the $0.00003 horizontal area. It finally moved above it after four unsuccessful attempts at breaking out.

If the increase continues, the next resistance will be at $0.000042, 38% above the current price.

Despite this bullish XEC price prediction, a close below the $0.000030 area can cause a 28% drop to the closest support at $0.000022.

Read More: Best Crypto Sign-Up Bonuses in 2023

Hedera (HBAR) Community Event Can Lead to Increased Interest

Price: $0.055

Market Cap: $1,921 billion

Rank: #31

An event co-hosted Hedera and Object Computing, Inc. will be held on November 14. The event will unveil new decentralized business solutions, including decentralized identity, sustainability, rewards, and data transparency.

The HBAR price is trading at a critical resistance, created by the $0.057 resistance area and a long-term descending resistance trendline.

Read More: 9 Best Crypto Demo Accounts For Trading

If HBAR breaks out, it can increase by 30% and reach the next resistance at $0.075.

However, if the price gets rejected, a 20% drop to the closest support at $0.047 will be expected.

The Graph (GRT) Concludes November Altcoins to Watch

Price: $0.136

Market Cap: $1,265 billion

Rank: #46

The final November altcoin is GRT. The Graph tweeted that a big announcement is coming on November 7. While there was no official news as to what this will be, the slogan is that “A New Era is Coming.” The team will also host Datapalooza, a day focused on web3 data innovations, on November 13.

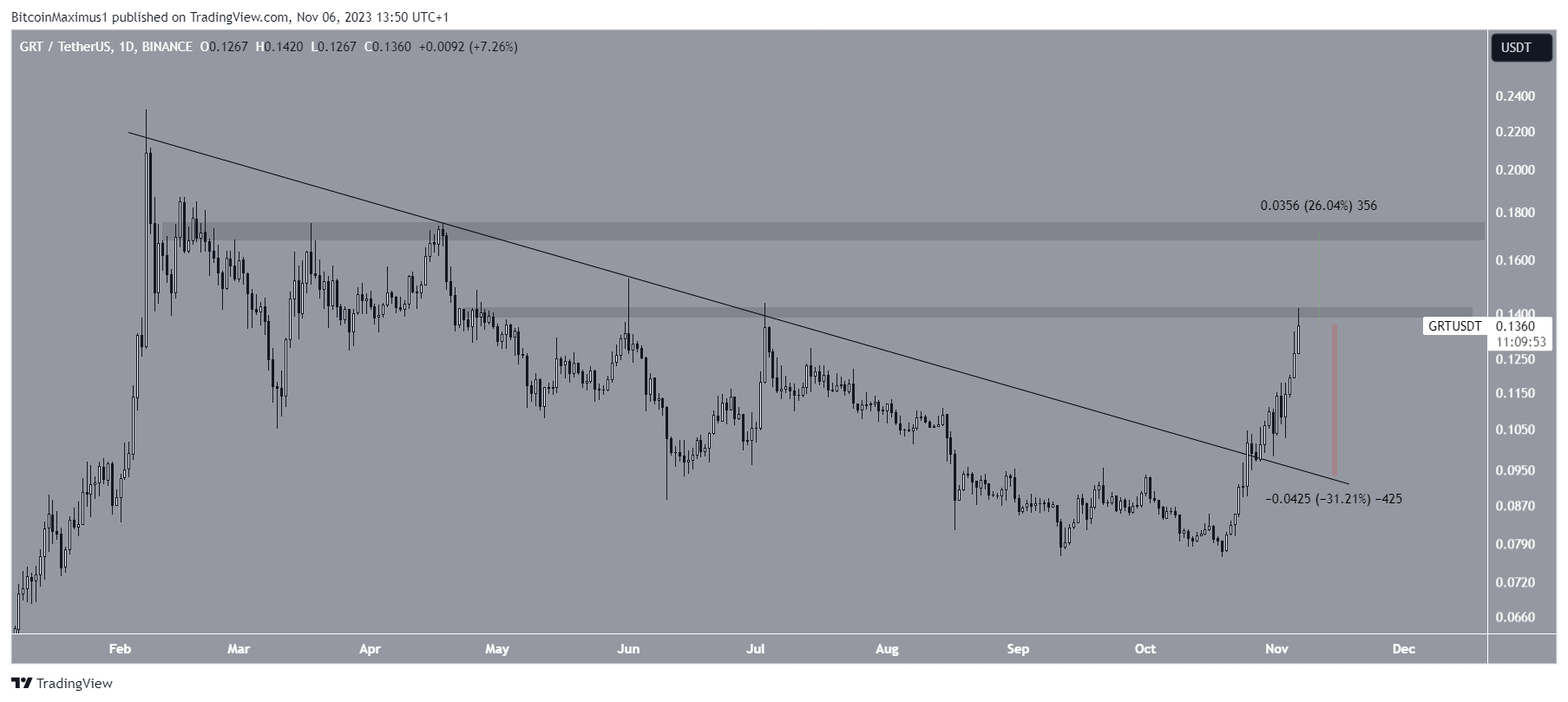

The GRT price broke out from a descending resistance trendline on October 25 and currently trades just below the $0.135 resistance area. If it breaks out, it can increase by another 25% and reach the next resistance at $0.170.

However, a rejection from the area can trigger a 30% drop to the trendline at $0.100.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link