US SEC Lawsuit, FTX Bankruptcy, and BitGo Updates Unveiled

[ad_1]

Bitcoin and Ethereum, two of the leading cryptocurrencies, have been in the spotlight recently due to significant developments surrounding the US Securities and Exchange Commission (SEC) lawsuit, the bankruptcy of FTX exchange, and the acquisition deal involving BitGo.

These updates have brought new dynamics to the crypto market, impacting the price predictions for Bitcoin and Ethereum.

In this update, we delve into the latest information and provide insights into how these events may shape the future of these digital assets.

Regulatory Actions and Lawmaker Criticism Impact Bitcoin Prices Amidst SEC Lawsuits

The cryptocurrency market has experienced a turbulent week due to lawsuits filed against major exchanges Binance and Coinbase by US securities authorities.

Lawmakers have criticized the enforcement actions taken by the US Securities and Exchange Commission (SEC) against cryptocurrency exchanges, describing them as a “complete contempt for Congress.”

There has been scrutiny directed at SEC Chair Gary Gensler and the agency’s approach to regulating the cryptocurrency industry.

Representative Ritchie Torres (D-NY), a member of the House Financial Services Committee overseeing the SEC, pointed out the evolving stance of Gensler, who has shifted from being a supporter to a critic of cryptocurrencies.

Torres suggested that Gensler’s portrayal of crypto as a villain is a way to present himself as a political hero.

Additionally, Congressman French Hill (R-AR), who chairs the House subcommittee on digital assets, highlighted the need for a clear and unambiguous legislative structure in response to the activities of Coinbase, Binance, and the collapse of FTX.

Hill stated that if the proposed bill had been in place, the SEC might not have needed to take the actions it did.

Last week, Hill and other lawmakers introduced a discussion draft of legislation seeking a comprehensive regulatory framework to foster innovation, fill regulatory gaps, and ensure consumer protection.

The growing criticism from US lawmakers towards the recent SEC actions, including Chairman Gary Gensler, has supported Bitcoin prices.

US Bankruptcy Court Rejects Plea to Transfer Management of $7.3 Billion in Assets from Troubled Cryptocurrency Exchange FTX

In a recent bankruptcy hearing held at the US Bankruptcy Court for the District of Delaware, a federal court denied a request to transfer control of $7.3 billion worth of disputed assets belonging to FTX, a troubled cryptocurrency exchange.

This decision dashed the hopes of Bahamian liquidators who sought to seize a portion of the assets through the Bahamian justice system.

The hearing, presided over by Judge Dorsey, centered around a crucial issue of determining the rightful ownership of FTX’s significant assets, which include a substantial amount of cryptocurrency and cash.

While Bahamian liquidators proposed that a Bahamian judge handle a portion of the bankruptcy case, FTX’s restructuring advisers, who took charge of the exchange following the arrest of its founder Sam Bankman-Fried for fraud, opposed this suggestion.

Judge Dorsey has not officially announced his decision on the matter, and he intends to provide a formal ruling when the case reconvenes on June 9.

BitGo Signs Preliminary Deal to Acquire Prime Trust, Expanding Cryptocurrency Custody Offerings

Cryptocurrency custody company BitGo has reportedly entered into a preliminary agreement to acquire Prime Trust, another licensed cryptocurrency custody expert based in Nevada.

While the acquisition is still pending regulatory approval, it holds the potential to enhance the industry significantly, according to Jor Law, the interim CEO of Prime Trust.

Law emphasized that the merged company would offer a comprehensive range of products, services, and expertise, enabling them to revolutionize the future of cryptocurrency and contribute to a larger ecosystem.

As the demand for digital asset custody continues to grow, particularly among institutional clients and high net-worth individuals, companies like BitGo and Prime Trust are crucial in providing secure storage solutions.

The need for reliable custody services has become increasingly important, leading to the development of regulations such as the US Securities and Exchange Commission (SEC) proposed rules to address custody difficulties and ensure the protection of cryptocurrencies.

Bitcoin Price Prediction

On Friday, Bitcoin displayed a choppy trading session at around 26,500 after gaining support around the $26,200 level.

On the four-hour chart, Bitcoin is currently testing the resistance level at $26,500 and could potentially aim for the next target at $27,400, benefiting from the negative US Jobless Claims report.

If Bitcoin breaks above the $27,400 level, it can reach the next target of $28,020 or possibly even higher.

Key technical indicators, such as the relative strength index (RSI) and moving average convergence divergence (MACD), indicate a buying trend, supporting the likelihood of a sustained upward movement.

The presence of the 50-day exponential moving average further reinforces the potential for continued upward momentum.

However, if Bitcoin experiences a breakdown below the $26,200 support level, it may find further support at $25,400.

Despite this, the overall bullish outlook remains stronger. It is important to closely monitor the price action around the $26,200 level as it may present potential buying opportunities.

If this scenario unfolds and Bitcoin fails to surpass the $28,300 level, investors may be able to engage in short selling below $28,300.

The initial target for such a move could be a decline to $27,500, followed by a potential further drop to the next support level at $27,000.

Conversely, suppose Bitcoin successfully breaks above the $28,300 level and secures a close above it. In that case, investors may consider taking long positions, targeting an initial resistance level of $29,000, with the next resistance likely located near $29,450.

Buy BTC Now

Ethereum Price Prediction

After the news of the SEC targeting Binance and Coinbase, the market experienced a significant decline.

As a result, Ethereum also faced downward pressure and is currently trading from $1860 to $1830. The technical indicators are showing a bearish sentiment.

The 50-day exponential moving average acts as resistance around the $1854 level, indicating a higher likelihood of further downside.

Additionally, both the RSI and MACD indicators are in the bearish zone, reinforcing the prevailing selling pressure.

It is crucial to monitor the $1830 level, as a breach of this support could expose Ethereum to the next support level at $1800.

A violation of the psychological level of $1800 may lead to further selling towards $1775 or $1760.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Keep yourself updated on the latest initial coin offering (ICO) projects and alternative cryptocurrencies by regularly exploring the handpicked collection of the top 15 most promising digital assets to monitor in 2023.

This thoughtfully curated list has been compiled by industry experts from Industry Talk and Cryptonews, guaranteeing that you have access to professional recommendations and valuable insights.

Stay ahead of the curve and uncover the potential of these cryptocurrencies as you navigate the constantly evolving landscape of digital assets.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

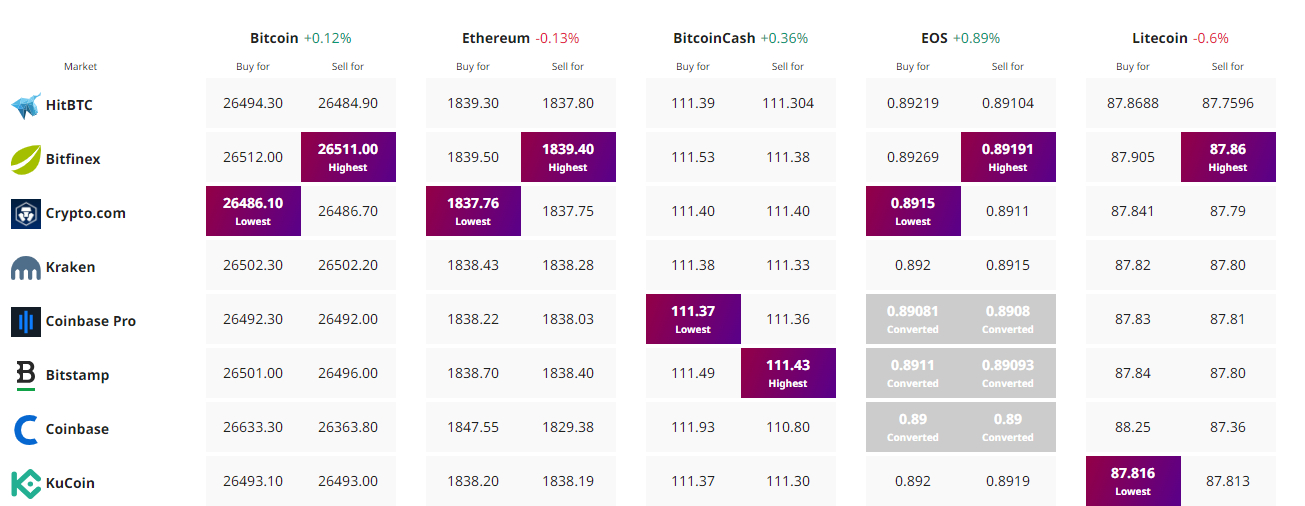

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

Source link