Bitcoin, Ethereum Poised for Big Price Movements

[ad_1]

Key Takeaways

Bitcoin is stuck between $21,500 and $21,000.

Meanwhile, Ethereum is trading between $1,250 and $1,190.

Closing outside these trading ranges will determine the trend’s direction.

Share this article

The cryptocurrency market had a quiet weekend as the top two assets by market cap, Bitcoin and Ethereum, continued consolidating. Still, a significant price movement appears to brew.

Bitcoin and Ethereum Primed for Volatility

Bitcoin and Ethereum remained stagnant over the weekend, but a few indicators suggest that volatility is about to resume.

BTC is stuck in a tight price range between $21,500 and $21,000 while ETH continues to trade between $1,250 and $1,190. Both cryptocurrencies have seen their prices squeeze in the last few days as the market sentiment remains in “extreme fear.” Interestingly, a particular technical indicator hints at the probability of a downswing.

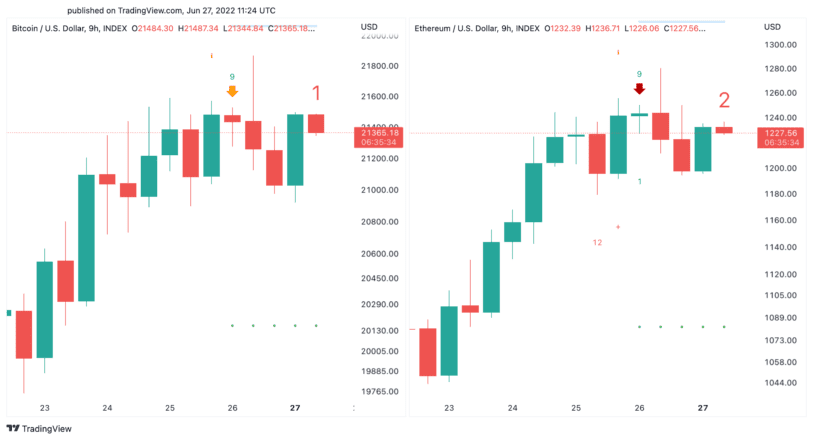

The Tom DeMark (TD) Sequential indicator recently presented sell signals on Bitcoin and Ethereum’s nine-hour chart. The bearish formations developed as green nine candlesticks, indicative of one to four candlesticks correction. Although BTC and ETH took a brief nosedive after the technical development, there hasn’t been a clear violation of support or resistance.

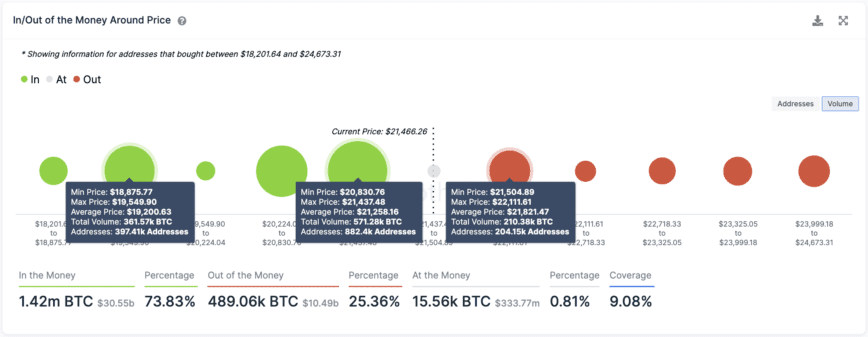

Transaction history shows two critical price points that may help determine where Bitcoin is going next. Roughly 882,400 addresses had previously purchased over 570,000 BTC between $20,800 and $21,500. Meanwhile, more than 200,000 addresses are holding over 210,000 BTC $21,500 and $22,100.

Given the lack of resistance ahead, a sustained nine-hour candlestick close above $22,100 could be significant enough to trigger a bullish breakout toward $25,000 or even $27,000. But if the $20,800 support level were to give up, the next crucial interest zone sits at $19,000.

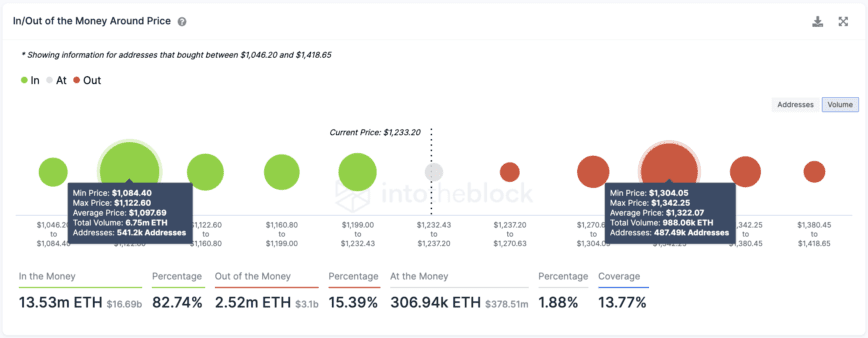

Transaction history also reveals that Ethereum cannot afford to lose the $1,100 support level. Breaching such a vital demand zone can trigger another sell-off that sends ETH to $600. Therefore, it’s imperative for Ether to slice through the $1,320 resistance barrier to have a chance of advancing toward $1,700.

The macroeconomic outlook still doesn’t look favorable as recession fears heighten. For this reason, it’s imperative to wait for a decisive close below resistance or above support to enter the markets. Although a few metrics suggest that the bottom is near, there could be more downward movement before the trend reverses.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

[ad_2]

Source link