Bitcoin, Ethereum Flip Bullish Despite Negative GDP Numbers

[ad_1]

Key Takeaways

Bitcoin and Ethereum have jumped more than 4% in the last six hours.

The upswing coincides with news that the U.S. economy contracted.

BTC and ETH are now trading around crucial resistance levels.

Share this article

The top two largest cryptocurrencies by market cap, Bitcoin and Ethereum, appear to have entered new uptrends despite the news that the U.S. economy has entered a so-called “technical recession.”

Bitcoin and Ethereum Head Higher

Bitcoin and Ethereum have enjoyed significant gains over the last few hours after the latest U.S. GDP print.

The total cryptocurrency market capitalization increased by roughly $40 billion following reports that the U.S. economy contracted for the second consecutive quarter. The Bureau of Economic Analysis affirmed that the U.S. Gross Domestic Product (GDP) fell 0.9% at an annualized pace.

With the U.S. economy now technically in a recession, Bitcoin appears to be taking the spotlight. The flagship cryptocurrency has gained more than 900 points in market value since the GDP numbers were released. Now that Bitcoin’s bullish momentum has been affirmed, the top cryptocurrency is showing early signals that it wants to move higher.

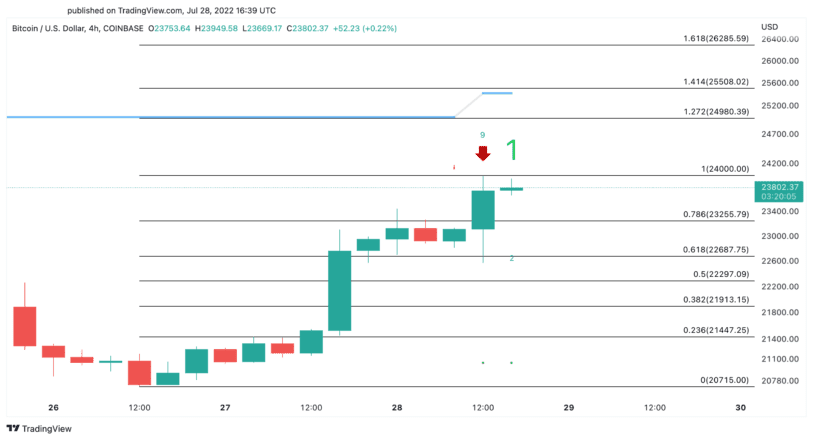

The Tom DeMark (TD) Sequential has presented a sell signal on the four-hour chart. Although the bearish signal anticipates a retracement to $23,260 or even $22,690, BTC is showing strength as it edges closer to $24,000. A four-hour candlestick close above this crucial area of resistance could invalidate the short-term pessimistic outlook and result in an upswing to $25,500.

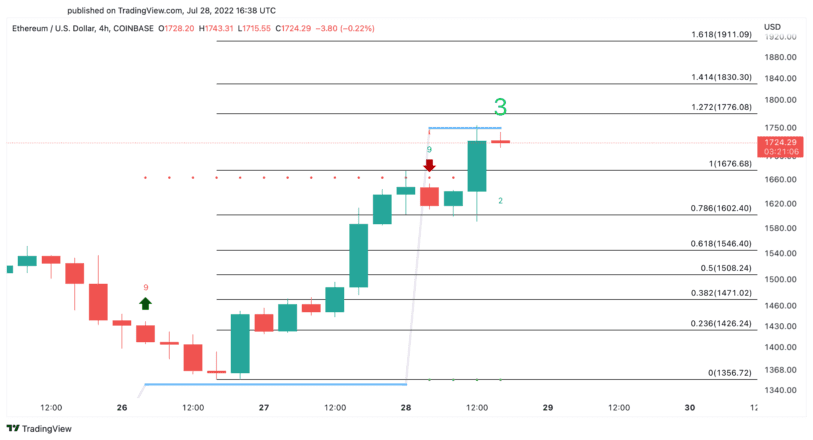

Likewise, Ethereum enjoyed a nearly 7% price increase in the past six hours. The upswing allowed ETH to slice through an important area or resistance at $1,650. Now, the TD’s risk line at $1,750 appears to be the next hurdle that ETH must overcome to advance further.

A decisive four-hour candlestick close above $1,750 could generate enough bullish momentum to push Ethereum to $1,830 or even $1,900. Still, ETH must hold above $1,680 to validate the bullish thesis. Failing to do so could trigger a spike in profit-taking that pushes Ethereum back to $1,600 or even $1,550.

While macroeconomic conditions continue to deteriorate, market participants may believe that the latest U.S. GDP numbers have been priced in. Negative growth may also force the Fed to switch to a more easing monetary policy sooner than anticipated. Even with so much uncertainty in the global economy, it appears that crypto assets are finding the strength to recover in the short term.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

[ad_2]

Source link