Bitcoin volatility at three-year low as crypto markets lull

[ad_1]

Key Takeaways

Crypto volatility has been dropping all year, with Bitcoin’s volatility now at three-year lows

Volume is also dropping, as the calm markets are not welcomed by traders

Despite downward-trending volatility, crypto remains highly volatile when compared to other asset classes

Crypto markets are known for violent volatility, capable of both spiking and collapsing in the blink of an eye.

Thus far this year, however, that hasn’t been the case. Volatility has been trickling steadily downward across the space. Assessing the realised volatility of Bitcoin over a rolling one-month window, the metric is currently at a three-year low.

This comes despite Bitcoin having had a bumper year thus far, the asset currently up 76%, treading water around the $30,000 mark. In the past, Bitcoin has oscillated wildly, but this run-up from the low of $15,500 late last year has been distinguished by a steady climb rather than the turbulent ups and downs we have come to expect.

The pattern is not unique to the world’s biggest crypto, either – volatility is falling across the board. The easy way to illustrate this is by looking at Ether. Historically, the price of ETH has been more volatile than BTC, but the divergence has narrowed this year, and Ether is now trading with similar volatility to its big brother.

This relative calm in crypto markets is good on one level, given one of Bitcoin’s most-cited criticisms is its extreme volatility, which most agree it will need to overcome should it ever take the status of a reputable store of value.

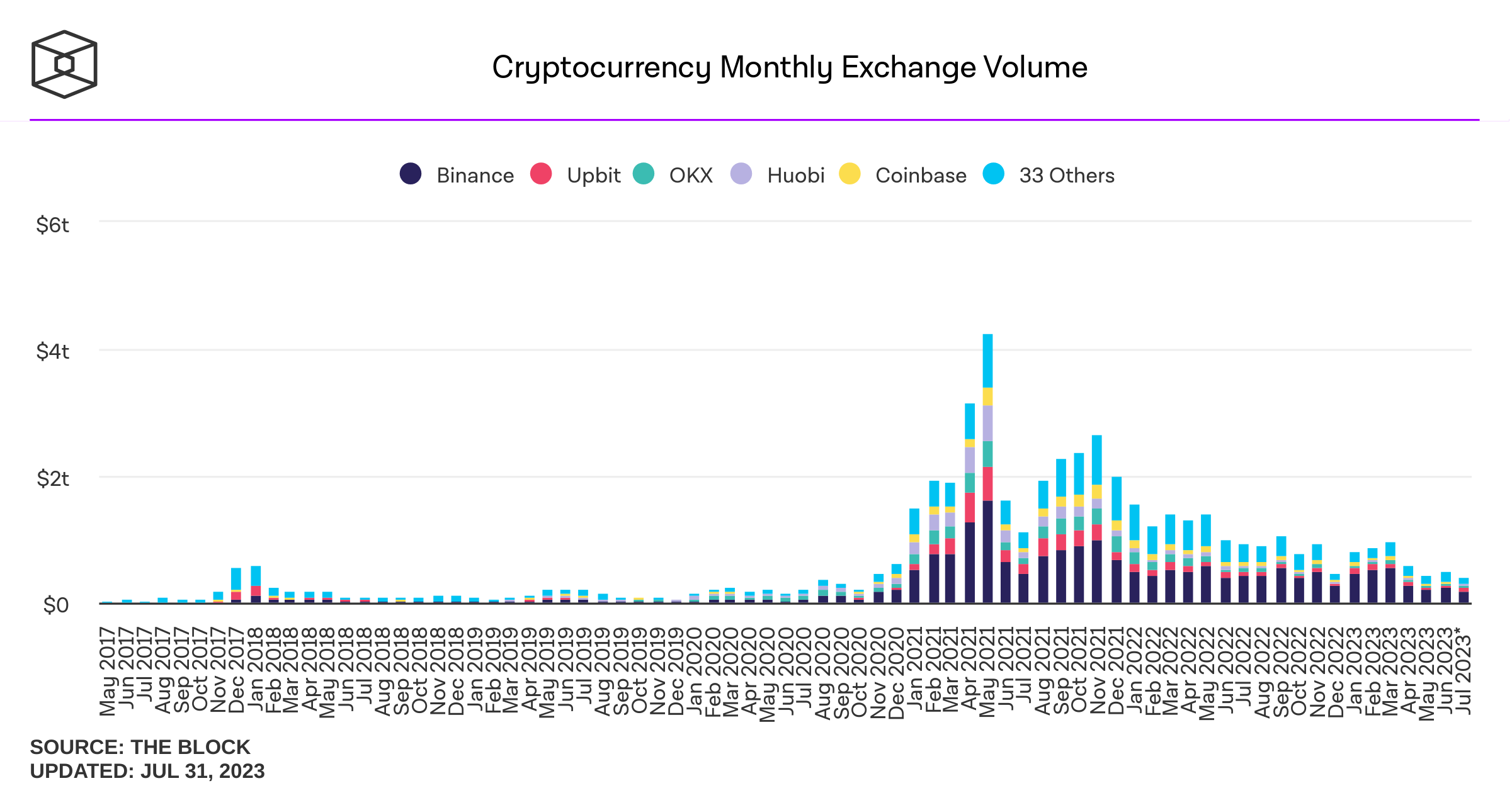

Not everyone is a winner, though. Traders rely on volatility and hence these serene times are not exactly a boon. If we look at spot trading volume, the drawdown has been steep. Granted, there are myriad factors at play here, including regulation, a drawdown in prices, lockdowns ending, scandals (FTX and the SEC lawsuits) and so on, but the lack of volatility is not helping.

The below chart from The Block shows quite how far spot volume has fallen.

Even derivatives trading volume, which had been more stout, has fallen off since April – likely a better gauge for traders than assessing spot volume. Liquidity is not as much of a concern in derivatives markets as it has become in spot markets, but the last few months have begun to see some thinning out there, too.

While the falling volatility is notable, it should be noted that crypto remains a league above trad-fi markets with regard to this metric. Even this three-year low still translates to an annualised volatility of 25% for Bitcoin, which would not be deemed low-risk by any stretch of the imagination.

To put this up in lights, comparing Bitcoin to gold is always illustrative. Gold is the store of value which has been around for thousands of years, the shiny metal known for its inflation-hedging abilities and lack of correlation to risk assets. For many, Bitcoin’s vision is to claim the title of some sort of digital gold.

The below chart displays the current gulf between these assets – even after the dampening down in crypto volatility this year, it’s on a completely different planet to gold.

Alternatively, one can simply compare the daily returns of the assets, which conveys the same thing.

Thus, while crypto volatility is currently sluggish, it has a long way to go before it matches gold. More importantly, there is no guarantee that this volatility will stay low. Quite the opposite – given the low liquidity in the space, less capital is needed to move crypto markets than has been the case previously.

In light of this, it feels like the downward trend in volatility (exacerbated in the last couple of months by a classic summer lull in trading) should return. Not to mention the fact that with the interest rate hiking cycle coming to a close, markets could be at an inflection point. It is always hard to predict the future in crypto, but it feels unlikely that digital assets’ volatility will stay at these uncharacteristically low levels for long.

[ad_2]

Source link