Bitcoin’s (BTC) Weekly Close Highest in 550 Days

[ad_1]

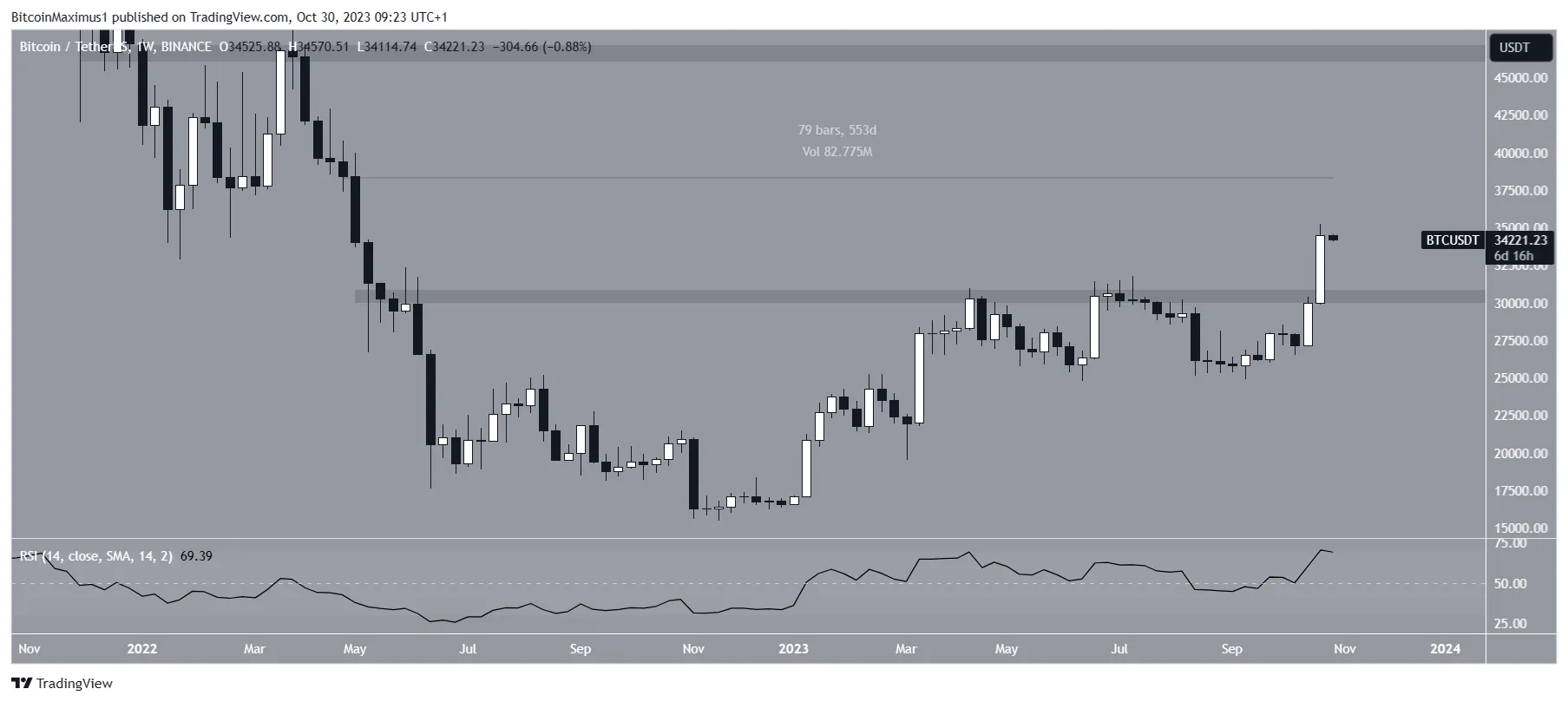

The Bitcoin (BTC) price reached a close of $34,525 last week, the highest weekly close in 550 days.

Bitcoin also broke out above the main long-term horizontal resistance area at $30,500, which had been in place since May 2022.

Bitcoin Reaches Highest Weekly Close in 550 Days

The weekly timeframe technical analysis shows that the Bitcoin price has increased sharply during the past two weeks. It broke out from the $30,500 area last week, reaching a new yearly high of $25,380.

While it fell slightly after the yearly high, BTC reached a weekly close of $34,525.

Check out the Best Crypto Sign-Up Bonuses in 2023

This was the highest weekly close in 550 days since Bitcoin closed at $38,468 in April 2022. At the time, the BTC price was in the midst of a significant downward movement.

The weekly Relative Strength Index (RSI) is bullish.

With the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have an advantage if the RSI reading is above 50 and the trend is upward. The opposite is true if the reading is below 50.

The RSI is above 50 and increasing, both considered signs of a bullish trend.

The Impact of Institutional Investment on Bitcoin

The approval of a Bitcoin Exchange-Traded Fund (ETF) is on the horizon, and its impact on the future price cannot be overstated.

Speaking to BeInCrypto, Mr. Rafay Gadit, the Co-Founder and CFO of social investment platform Zignaly stated that if approved, a Bitcoin ETF can attract institutional investors, boost confidence, and drive demand and prices.

However, rejecting the ETF can create a short-term bearish sentiment in the cryptocurrency market.

Gadit believes that the fact that institutions like BlackRock are getting involved demonstrates Bitcoin’s growing importance in finance, recognizing it as a potential store of value or investment.

Read More: Best Crypto Sign-Up Bonuses in 2023

As for the price movement, this institutional investment can drive up prices in the short-term. In the long-term, it can stabilize them since institutional holdings are historically much less volatile than retail investments.

Finally, he believes that this increased interest has contributed to the BTC price increase to $35,000. The upward movement can be sustained unless the BTC or Ethereum (ETH) ETF gets rejected.

Nevertheless, Gadit stresses that traders should still be careful in their position sizes and always use stop losses to limit potential losses in case of an adverse market movement.

BTC Price Prediction: How Long Will Increase Continue?

Technical analysts employ the Elliott Wave theory to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The daily timeframe Elliott Wave count is bullish, supporting the possibility that the upward movement will continue.

Stay ahead in the game with Bitcoin (BTC) price forecasts.

The most likely count suggests that Bitcoin is in wave three of a five-wave upward movement (black). The sub-wave count is given in white, suggesting that BTC is in sub-wave four, which is corrective.

After the correction is complete, the most likely target for the top of the fifth sub-wave is at $39,200, 13% above the current price.

The target is found by the 0.618 Fib retracement length of waves one and three combined, and the resistance trendline of an ascending parallel channel.

Despite this bullish Bitcoin price prediction, a close below the channel’s support trendline at $33,000 will invalidate the count.

In that case, a 13% drop to the closest short-term support at $30,000 will be expected.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link