BNB breaches key support

[ad_1]

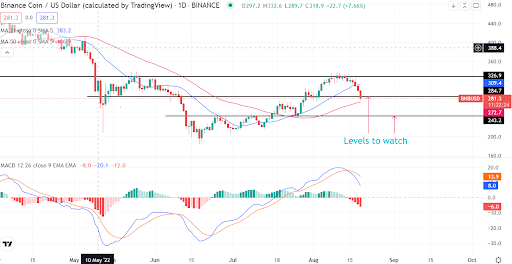

Binance coin has returned more than 77% since the June bottom price.

The token hit the resistance target at $326, forcing profit-taking activities.

BNB has temporarily broken below key support, although a bearish momentum is not yet confirmed.

By all means, Binance coin BNB/USD has returned massively for investors who targeted $326 resistance. The level, hit during the first week of August, represents an upsurge of 77% since BNB bottomed at $142. To a technical reader, $326 represents a take-profit zone. That reveals why the token lost momentum after hitting the level. BNB now trades at $280.

BNB slowdown is connected to profit-taking activities rather than weak fundamentals. Whereas the price could climb above $326, investors remain cautious as the recession risks remain. As of press time, most cryptocurrencies remained in the red. However, we can’t confirm a bear market as of now.

BNB trades at a key level as price slides

Source – TradingView

From the daily chart outlook, BNB is under pressure. The momentum line has crossed below the moving average, suggesting a bearish push. The cryptocurrency has also broken above the 21-day MA but remains supported by the 50-day MA.

Two scenarios are likely as BNB trades at key support of $285. In the bull case scenario, the daily candle stick could close above the support, leaving a bearish pin bar. That will allow bulls to take control and push the token back to $326. The scenario will see BNB remain supported by the 50-day MA.

In the bear scenario, the daily candlestick will close below the support zone. That could be followed by a bear confirmation candlestick. The bear scenario will see BNB move back to $244.

Concluding thoughts

Investors should watch the close of the daily candlestick on BNB. That will reveal whether BNB will enter a bear market or begin a bull reversal.

[ad_2]

Source link