Can BNB Price Finally Clear Long-Term Resistance?

[ad_1]

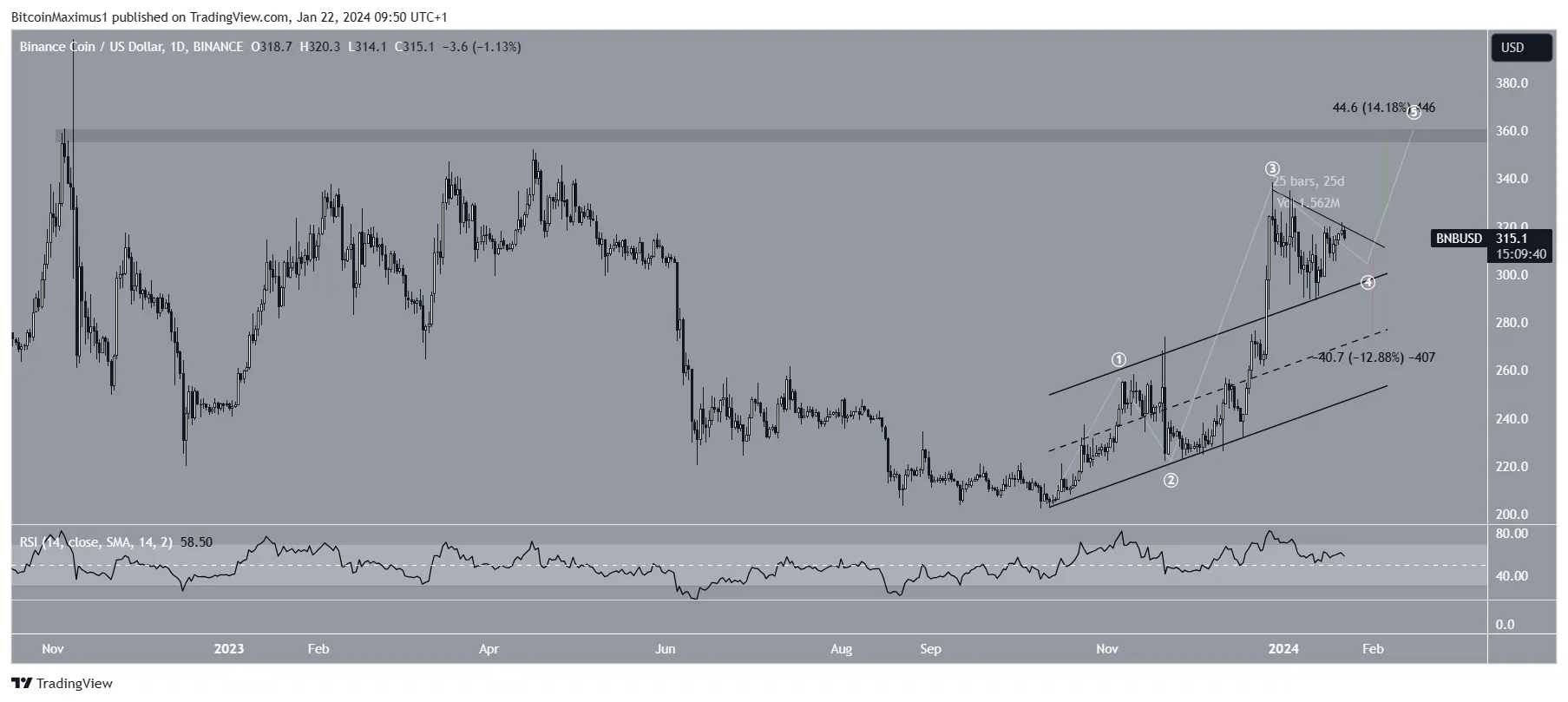

The BNB price broke out from a long-term descending resistance trend line but traded below a horizontal resistance area.

BNB also emerged from a short-term pattern and attempted to move above a short-term resistance trend line.

BNB Approaches Resistance

The BNB price has fallen under a long-term descending resistance line since November 2021, leading to a low of $183 in June next year. The price has increased since.

After a failed breakout attempt, BNB finally moved above the resistance trend line in December 2023, when the trend line had been in place for 770 days. This led to a high of $338, just below a horizontal resistance area. BNB sustained the increase but has not broken out yet.

When evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true. The RSI is above 50 and increasing (green icon), indicating a bullish trend.

Read More: How to Buy BNB?

BNB Ecosystem Keeps Growing

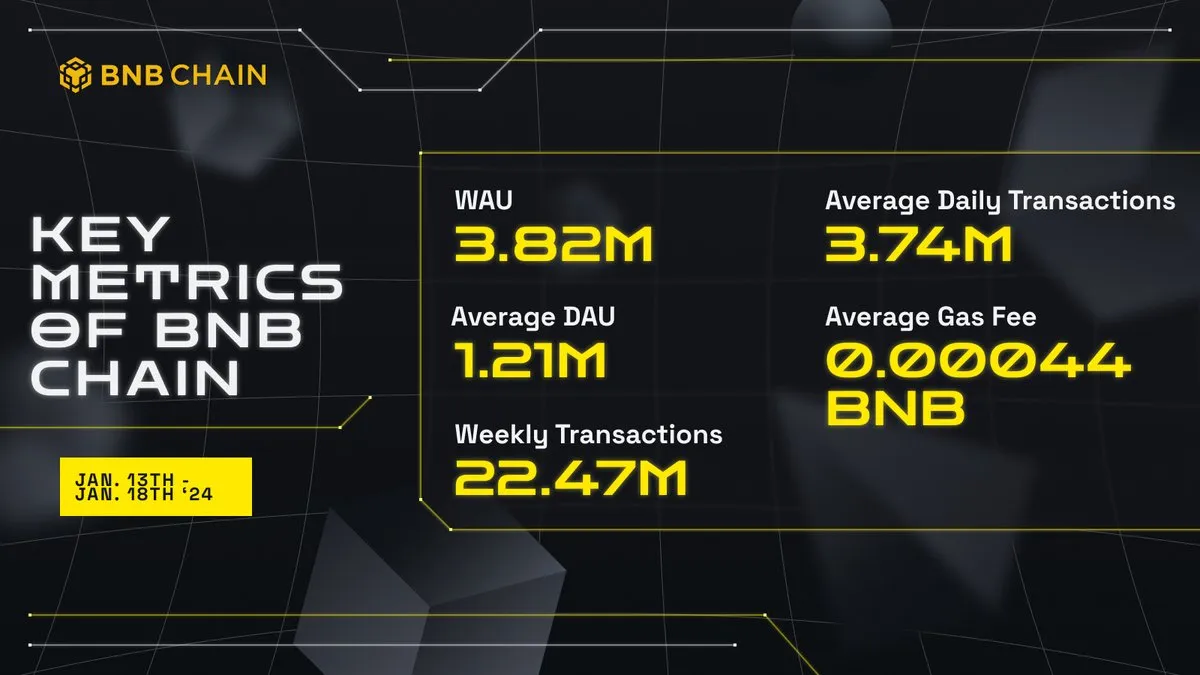

The BNB team posted statistics for the ecosystem today. The chart shows that there have been 3.74 million daily transactions at a minuscule average gas fee of only 0.00044 BNB.

Additionally, the team has announced the BNB Chain Hackathon 2024. Application submissions are open until February 1, with a prize pool of over $1 million.

Finally, the team will discuss opBNB in an open session tomorrow. OpBNB is an optimistic rollup network that helps the BNB Smart Chain scale.

Read More: What is BNB And How It Works

BNB Price Prediction: Will Upward Movement Continue?

The daily time frame aligns with the weekly readings. It shows the BNB price broke out from an ascending parallel channel in December 2023. This is a sign that the upward movement is impulsive.

While BNB has fallen under a short-term descending resistance trend line for the past 25 days, it has made numerous breakout attempts. Since trend lines weaken each time they are touched, an eventual breakout from the resistance trend line is expected.

The wave count supports this outlook. Technical analysts utilize the Elliott Wave theory to ascertain the trend’s direction by studying recurring long-term price patterns and investor psychology.

The most likely count suggests that BNB is in wave four in a five-wave increase (white). Wave four has become a symmetrical triangle, the most likely pattern for such a correction.

Finally, the daily RSI is above 50 and increasing both bullish signs. If BNB breaks out, it can increase 14% to the next resistance at $360.

Despite this bullish BNB price prediction, a decrease inside the channel can cause a 13% drop to its midline at $280.

Read More: Best Wallets for BNB

For BeInCrypto‘s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link