Cathie Wood Bullish on Bitcoin and DeFi, Shades SBF

[ad_1]

CEO of Ark Invest, Cathie Wood, is bullish on Bitcoin despite the FTX collapse, stating that the Bitcoin blockchain continued to operate as usual.

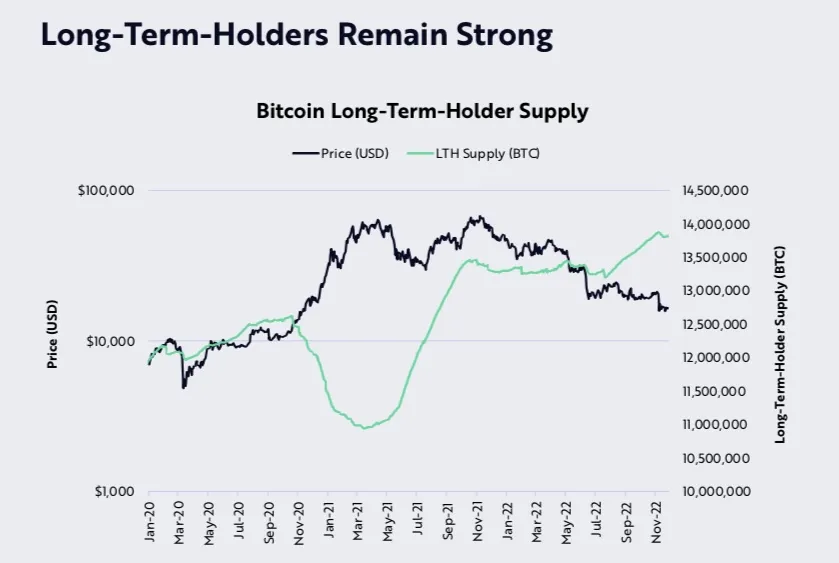

In a December 11 tweet quoting Ark Invest’s November report on long-term holders BTC’s supply, she noted that the blockchain had shown resilience while taking a dig at FTX Founder Sam Bankman-Fried.

SBF Didn’t Like Bitcoin Because He Couldn’t Control it: Wood

According to her, the Bitcoin blockchain didn’t skip a beat during the crisis caused by opaque centralized players.

She said SBF did not like Bitcoin because it was transparent and decentralized, adding that “he couldn’t control it.”

Wood remains very bullish on cryptocurrencies and believes that the bankruptcies of centralized entities will boost the decentralized finance sector.

Wood Bullish on DeFi

In an interview with Yahoo Finance on December 9, Wood noted that DeFi networks have been working as programmed and pointed out that there are metrics that show that they are getting stronger. She said:

“I think what we’re learning because of FTX is how much more important fully transparent decentralized networks will be to financial services going forward… FTX, Celsius, 3AC were all closed networks. Opaque systems. You couldn’t see what was going on…”

In her opinion, the DeFi sector’s transparency, even amid the crypto crises, will always be its saving grace.

Ark Invest Says Decentralized and Transparent Blockchains Remain Strong

Ark Invest Bitcoin Monthly report also painted a gory picture of what happened in November with FTX collapse and BlockFi filing for bankruptcy. The month saw very high capitulation, with the ratio of realized profits and losses for Bitcoin reaching a record low.

However, long-term BTC holders saw their supply stabilize at 13.8 million BTC, close to an all-time high.

Even amidst this bloodbath, Ark Invest noted that “decentralized and transparent public blockchains are as strong as ever.”

The report recommended that “decentralization and transparency are paramount as antidotes to the gross mismanagement that can be associated with centralized intermediaries.”

Meanwhile, crypto firms with exposure to FTX are still suffering from the fallout. Crypto media outlet The Block’s CEO Michael McCaffrey resigned following revelations that he got an undisclosed loan from Alameda.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link