Monero Looks Primed to Retrace to $150

[ad_1]

Key Takeaways

Monero could retrace by more than 20% over the next few days.

A sustained close below $191 should validate the bearish thesis.

XMR will likely need to claim $207 as support to be able to advance further.

Share this article

Monero has rallied over the past week. However, further gains could be limited as several technical indicators are pointing to a significant pullback ahead.

Monero Could Take a Nosedive

Monero looks primed for a steep correction after outperforming most cryptocurrencies in the market.

Demand for the privacy network’s XMR token appears to have risen following Terra’s UST and LUNA collapse. XMR has surged by more than 75% since May 12, while Bitcoin and many other assets continue to struggle. Now, it appears that XMR has reached overbought territory with a potential retracement ahead.

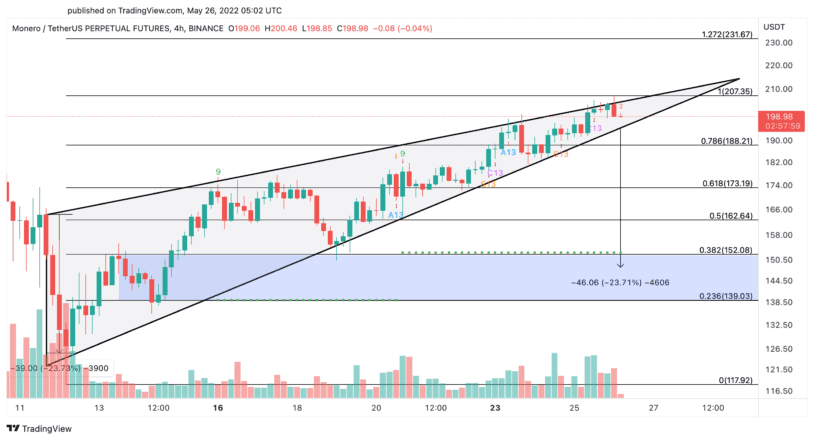

XMR’s price action appears to have led to the formation of a rising wedge on its four-hour chart. This technical pattern is typically seen in bear markets and, accompanied by low trading volumes, can signal the continuation of a downtrend. A decisive four-hour candlestick close below $191 could validate the pessimistic outlook.

Slicing through this crucial area of support may encourage traders to exit their positions, accelerating the downward pressure behind Monero. A spike in sell orders could lead to a breach of the $188 demand zone, which would likely be followed by a 20% correction toward $152 or even $140.

Although the odds appear to favor the bears, Monero could invalidate the pessimistic outlook by overcoming the $207 resistance barrier. A sustained four-hour candlestick close above this supply zone could encourage traders to increase their positions, potentially helping XMR advance toward the $232 level.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.

Share this article

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media, Inc. is not an investment advisor. We do not give personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may become outdated, or it may be or become incomplete or inaccurate. We may, but are not obligated to, update any outdated, incomplete, or inaccurate information.

You should never make an investment decision on an ICO, IEO, or other investment based on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an ICO, IEO, or other investment. We do not accept compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

See full terms and conditions.

[ad_2]

Source link