Top Bitcoin Miner to Invest $240 Million After the Halving

[ad_1]

North American Bitcoin mining company Bitfarms Ltd. has taken a bold step with a $240 million investment into upgrading its mining capabilities.

This upgrade is strategically timed to precede the expected Bitcoin halving event, which is anticipated to occur on April 20, 2024.

Bitfarms’ Bold Leap in the Anticipation of Bitcoin Halving

Bitfarms has confirmed the acquisition of new mining equipment as part of its fleet upgrade and expansion plan. According to Geoff Morphy, President and CEO of Bitfarms, the company secured 28,000 Bitmain T21 miners in March.

These miners were obtained through a purchase option. Additionally, they acquired an extra 19,280 Bitmain T21 miners, 3,888 Bitmain S21 miners, and 740 Bitmain S21 hydro miners.

“Together, with our 35,888 Bitmain T21 purchases and farm expansions announced in November, these new 87,796 miners are sufficient to reach 21 EH/s by year-end, with greater operating efficiency,” Morphy added.

Read more: The Best Free Bitcoin Mining Methods in 2024

Ben Gagnon, Chief Mining Officer at Bitfarms, shared insights into the immediate impact of the fleet upgrade.

“As we enter the Halving, we remain focused on our 2024 transformational fleet upgrade and expansion plan, which triples our hashrate to 21 EH/s, increases our targeted operating capacity by 83% to 440 MW, and improves our fleet efficiency by 38% to 21 w/TH. … Bitfarms is well positioned, with a strong balance sheet, to execute on our growth plans and capitalize on opportunities in the upcoming bull market and beyond,” Ben Gagnon, Bitfarm’s Chief Mining Officer, said in a statement.

Besides announcing its latest upgrade, Bitfarms also reported its performance increase in its March 2024 update. Despite challenges such as grid curtailment programs and the need for facility maintenance, the company achieved a 35% increase in its hashrate compared to the previous year.

During this reporting period, Bitfarms successfully mined 286 BTC.

Embracing Efficiency: The New Era for Bitcoin Miners

The broader context of Bitfarms’ upgrade comes amidst a wave of strategic moves by other major Bitcoin mining companies, such as CleanSpark. In early February 2024, CleanSpark also announced significant investments in mining infrastructure.

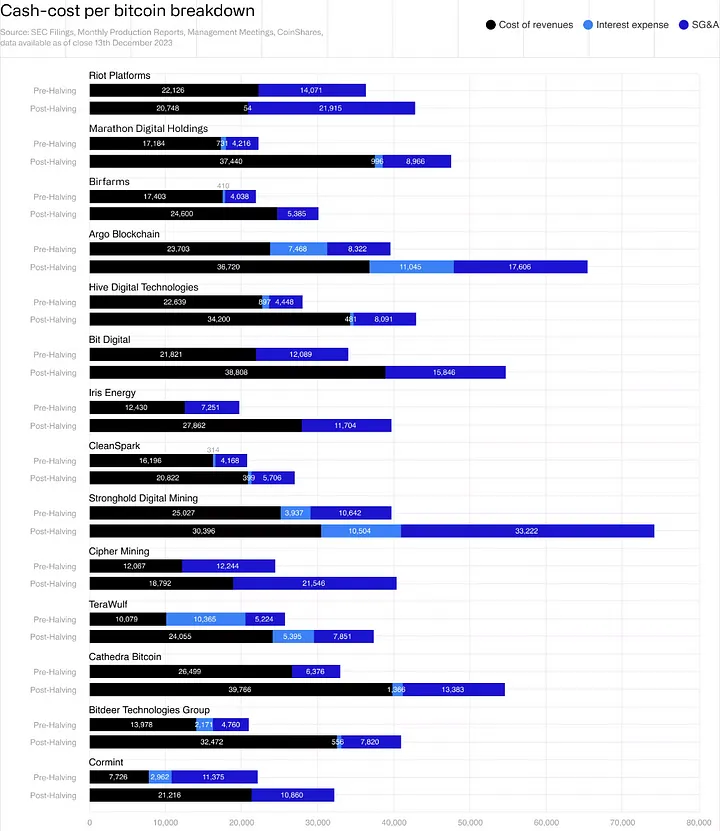

As Bitcoin halving will cut miner rewards in half while mining costs will increase, many believe this will significantly impact the mining industry. A January 2024 study by CoinShares reveals that miners with substantial Bitcoin holdings and better capitalization tend to fare better in bullish markets.

However, those with limited cash reserves and high operational costs per Bitcoin are more vulnerable to declines in Bitcoin’s price.

Read more: How Much Electricity Does Bitcoin Mining Use?

“Riot, Marathon, Bitfarms, and Cleanspark are best positioned going into the halving. One of the main problems miners have is large SG&A costs. For miners to break even, the halving will likely force them to cut SG&A costs, otherwise, they could continue to run at an operating loss and having to resort to liquidating their HODL balances and other current assets,” the analysts at CoinShares wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link