Why Bitcoin Price Impact is Greater for GBTC Than Silk Road

[ad_1]

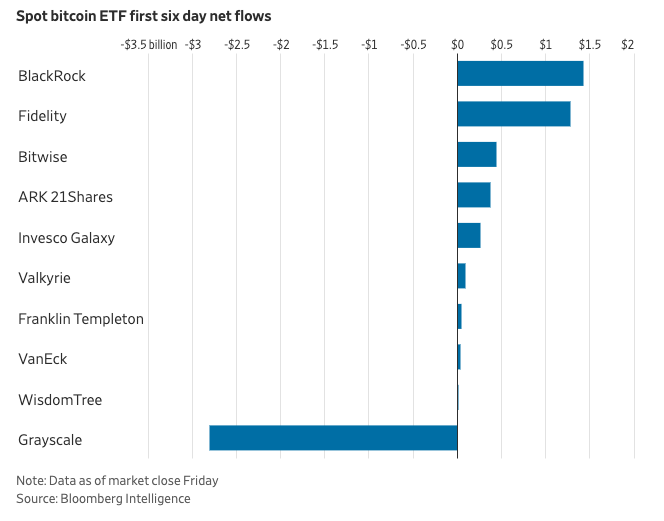

Some market commentators have expressed concern about the US government’s plans to sell Bitcoin seized from the Silk Road saga. But $130 million is a penny compared to outflows from the Grayscale Bitcoin Trust (GBTC) exchange-traded fund (ETF).

Yesterday, the US government said it would sell around $130 million worth of BTC from sentenced Silk Road drug traffickers. Fears of massive sell pressure ensued from Bitcoin investors.

Why Some Sales Won’t Impact Price

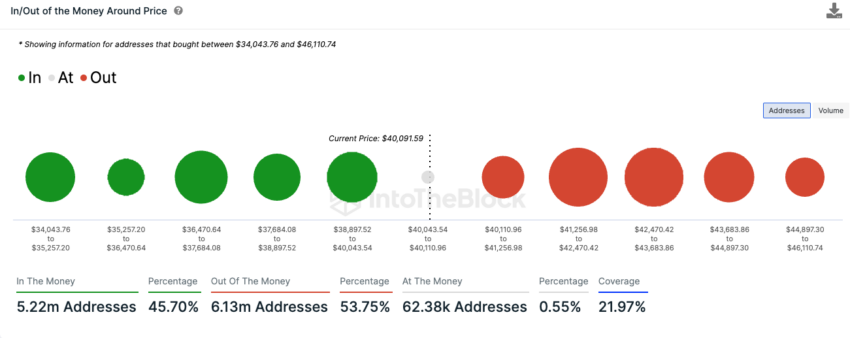

However, Bitcoin maximalist Steven Lubka said a Silk Road dump is ‘peanuts’ compared to the $2.8 billion going out from exchange-traded funds (ETFs). Two days ago, the price of Bitcoin was down 20% under $40,000, placing many pre-ETF investors underwater. Over half of investors who bought Bitcoin at pre-ETF levels of between $34,034.76 and $46,110.74 are underwater, according to data from IntoTheBlock.

Read more: Ross Ulbricht: The Real Story Behind the Silk Road Founder

Therefore, sales of seized Silk Road BTC could be negligible. Critics have blamed large GBTC outflows on Grayscale’s fees.

Recent reports suggest a large percentage of GBTC sales came from FTX, an exchange that collapsed in 2022. In the past week, FTX reportedly sold roughly $1 billion worth of GBTC holdings.

Bloomberg ETF analyst James Seyffart suspects the largest holder of GBTC, the Digital Currency Group (DCG), may also be selling. According to recent financial reports, DCG owns about $1.3 billion worth of GBTC shares.

“The largest “known” holder of GBTC is actually DCG itself. I’d honestly be surprised if DCG hasn’t been part of this GBTC selling.”

The company may have sold GBTC to cover legal costs. Such sales need not be disclosed by law since DCG is a private company. It may choose to report this information voluntarily.

On the other hand, a public company must include such transactions via earnings reports and filings with regulators. It will be clearer which companies sold shares of GBTC at future earnings calls.

Why Mt Gox Won’t Impact Price

A tangential event that could impact the price of Bitcoin is repayments from the Mt. Gox bankruptcy. The estate will start BTC and Bitcoin Cash (BCH) repayments to creditors this week. Customers lost 850,000 BTC when the exchange failed in 2014.

Creditors could profit from an 80x increase since the collapse. This sales volume may cause more pressure before Bitcoin’s halving.

According to crypto investment firm CoinShares, daily volatility of 1-5% is not abnormal. The Mt. Gox impact could be minimal if creditors stagger sales.

Read more: Bitcoin Price Prediction 2024/2025/2030

April’s Bitcoin halving could mitigate the long-term effects of large sales in the medium to long term. The baked-in supply reduction occurs approximately every four years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link